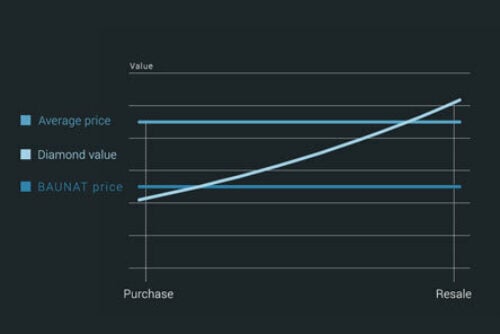

The projected price increase of diamonds will strongly dilute if the investment diamonds are not bought at the source. The further away you purchase your diamonds from the source (i.e. where they are polished), the more likely your future profit potential will be (partly or even entirely) evaporated via margin addition by intermediate parties. This is why it is crucial to cooperate with parties who can purchase at the source.

Maximise your Return on Investment

Value accumulation

The price for any given quality of diamond can vary a lot depending on where you purchased them. From an investment point of view, it is important to buy at the best possible price. Over time, the value of the diamond is expected to rise due to the declining supply and growing demand. The lower your purchasing price, the faster you will be able to sell your diamond at a profit, and the higher this profit will be.

Click here for more information about the profitability of diamonds.

When to resell?

A diamond is not a speculative good. A diamond is and should be treated as a long-term investment. We offer a free valuation for diamonds bought at BAUNAT over one year ago, but we advise holding diamond investments for a much longer period to maximise the return on investment. Upon request, BNT Diamonds will advise its clients during a potential resale.

How it works

Our experts provide you with a current price quotation for the diamond on sale, along with advice based on the price evolution of diamonds of this quality. Based on the price evolution, your initial purchasing price and the current quotation, you will receive a recommendation on whether you should sell or hold to maximise your return on investment.

Our mission

The BNT Diamonds mission is to maximize the chances for future profitability of our clients’ diamond purchases or investments. To achieve best results, we advise our clients when building their portfolio until the liquidation of their goods.

Personal guidance tailored to your portfolio