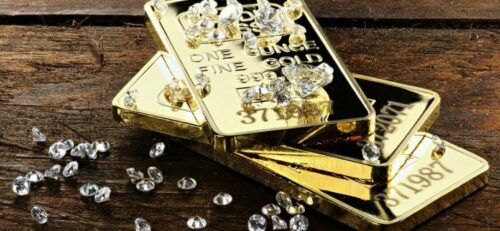

During the past budgetary talks the capital gains tax was a controversial issue. The tax targets capital gains on listed and unlisted shares. Many investors suspiciously followed this discussion. The capital gains tax on shares is coming, but there are alternative investment goods, like gold or diamond as an investment where the tax does not (yet) apply.

Bonds

If interest rates go down, bond rates go up. The capital gains on bonds are therefore exempt from taxes.

Real estate

In most cases, real estate is also exempt from taxes. There are a few exceptions to this. Whoever resells a house within 5 years after purchase, will need to pay a capital gains tax at a tax rate of 16.5 percent. If it is the only house or if one inherits the house, no taxes are imposed. Rental income is also exempt from taxes. As owner you still have to pay property taxes every year. Theoretically, that tax is based on the cadastral income which is equal to the net rental value. In reality however, the cadastral income – for example with renovated houses – is often a lot lower than the rental value.

Branch 23-Funds

During the running time of the contract there are no additional taxes. Only an entry cost of 2 percent premium tax is charged. New increases in dividend or stock market taxes are never an issue. The only issues are the entry and management costs.