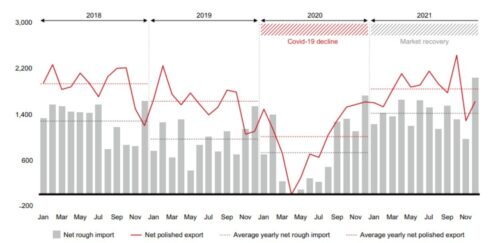

Meanwhile, India, the major player in the diamond polishing industry, has taken various measures to counteract this temporary “overstocking”, by planning to pause or reduce imports of new natural high-quality diamonds, to reduce the availability of polished diamonds.

Moreover when looking ahead on the long term, the supply of natural rough diamonds is expected to trend downwards, particularly for higher qualities, creating an anticipated shortage. No major new mines are in the pipeline, and minimal investment has been made in exploration for over 25 years. The closure of older mines, like the Argyle mine, has contributed to further diamond scarcity.

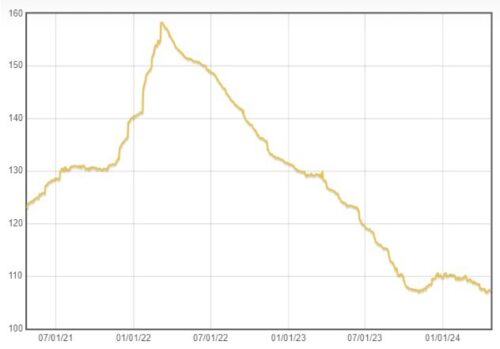

In summary, the temporary oversupply will be “corrected”, thus prices are expected to stabilize and to start raising again in the nearby future. Our assessment, which reflects the consensus within the industry, is that we have reached the floor and that it is a matter of time that the structural upward correction will happen. So this drop offers opportunities to investors to increase their return.

Conclusion: interesting time to invest

Based on our industry insights, there are reasons to believe that investing today in high quality natural diamonds is opportune.