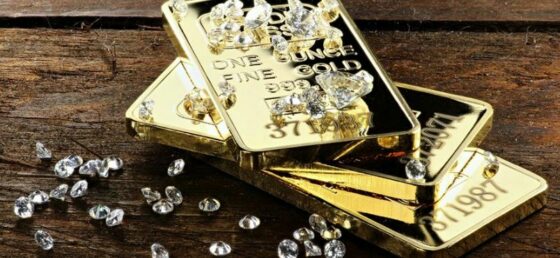

An increasing number of investors are going for the investing in diamonds or gold option in times of crisis. These raw materials never lose their intrinsic value and are therefore a safe choice. But all they all equally stable?

Diamonds as an alternative investment

In one of our previous blogpost we already discussed several different ways to invest your money. One possibility is investing in raw materials. This way of investing has become more popular in recent years. But what does this way of investing actually entail?

Diamond, gold, platinum or art? Which investment is profitable?

The trend to transfer money into tangible wealth, such as diamonds, has once again gained popularity over the decades. However, buying loose diamonds as an investment is old news. Throughout history, prominent people have used precious stones to visualize and measure their wealth. Today it is obviously not necessary to exchange these diamonds for boats or your life. But why has the interest in buying loose diamonds still increased?

Why investing in gold (mistakenly) remains popular

Like diamond, gold has been fascinating mankind for centuries. This is not only because of its value, but also because of the many misunderstandings and fables around it.

Saving for the children: from savings accounts to investing in diamonds

We all want give our children or grandchildren a push start in life, a nice cash reserve they can use when they are adults. When you are saving for your children, “Long term” is the key word.

Investing in monetary funds unjustly popular?

Which private investor is willing to be part of the ability to invest with a negative return? You would be kind of crazy. Nevertheless that is exactly what institutional investors, such as pension funds and insurers, do. Billions of euros are being invested in such funds, of which you already know that the return will be negative. Why do they do this?