Rubies are the world’s second rarest gemstones after diamonds. This intense red stone has enjoyed uninterrupted fame for centuries and is a symbol of love and passion. High quality rubies are therefore highly sought-after by collectors or private buyers. However, selling rubies at a healthy profit requires a thorough knowledge of this specific segment of the market. In this article we will clarify how to sell your rubies and what factors to take into account.

Buying diamonds or investing in mixed investment funds?

Many savers are pushed towards alternatives in their search for profitability. The threshold towards high risk equity funds is generally too high, where you invest in both shares and bonds. Meanwhile the capital in such funds has surpassed that of pure shares funds. In 2015 Belgian investors have put 173 billion euros into investment funds, of which 54 billion has been put into mixed investment funds. Another alternative for the classic savings account is buying diamonds.

Purchasing diamonds as alternative investment

Gold prices can fluctuate significantly, depending on events that are out of our control, such as election results, harvests, decisions made by actors on the financial market and so on…

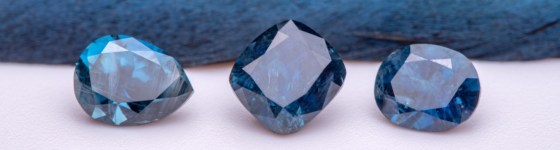

Which investment is most interesting? Blue sapphire or blue diamond?

Blue sapphires are currently on the rise in the jewellery landscape. The effect of the ring with blue sapphire gracing the finger of Kate Middleton, and previously Lady Diana, is tangible for many jewellers. One great benefit for the blue sapphire compared to the blue diamond is its lower price. However, as an investment, we still recommend buying a blue diamond rather than a blue sapphire.

What is the best investment? Cacao, iron ore or diamond?

One of the best investments in the economically unstable 2015 was without a doubt cacao. The value increase in international markets was 9,7%, while many other raw materials such as gas (-17,4%), crude oil (-32,11%), iron ore (-32,35%) and copper (-24,77) sustained heavy losses. Everyone loves chocolate, regardless of the economic conditions. A constant high demand leads to price increase in the market with a stable or declining supply.

Diamond as an investment, is it a good idea?

If you followed up the development of the bond market the previous years, you know that even today the safest investments are considered risky. Also, the stock market gives us no inspiration and saving accounts aren’t profitable anymore. Real estate is sometimes considered as a good investment alternative, but there are many uncertainties: you have no cash available anymore, you are committed to your location or the tax rules can be changed…