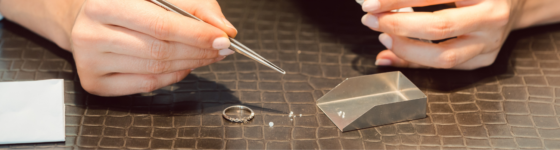

Being an active investor might end up being very lucrative, it comes with challenges of its own and many misconceptions about selling diamonds to avoid. Not only do you need to pick the right investments for a diverse portfolio and follow the market as they grow, you also need to know when and how to liquidate them. Which steps do I take to be sure to get the right returns?

What determines the prices of diamonds?

Everyone knows that diamonds are expensive, but especially assessing the proper value of a diamond is difficult. The price of diamonds is expressed in US dollar per carat. A 0.50 carat diamond for example, has a price of $ 1400 * 0.50 Ct, so that equals $ 700.

Investing in diamonds and the carat tax

Diamond traders will no longer be taxed on their annual profit, but on the revenue instead. Up until now, they had to pay corporate tax on their annual declared profit. By changing the basis of the tax to the revenues generated, there will be fewer possibilities to commit fraud.

The stable and positive price evolution of diamonds as an investment

Investing is always a risk, but in general, diamonds are considered a sustainable and safe choice. Isn’t it interesting to opt for diamonds as an investment in the long term? Therefore, a long term research is necessary.

How is the price of diamonds determined?

Diamonds have always been a sign of prosperity. They still have the image of being expensive and unreachable, a privilege for those with the exorbitant funds for such luxury. Although diamonds are still not a common good, there is more variation in the price of diamonds than it used to be.

How the diamond value remained stable during the economic crisis

Many countries have experienced a dark period on the economic front. In these uncertain days, people wanted to protect their assets. For this reason, some people invested in commodities, because these are easy to resell in times of need. To buy loose diamonds is only an example of investments in commodities.