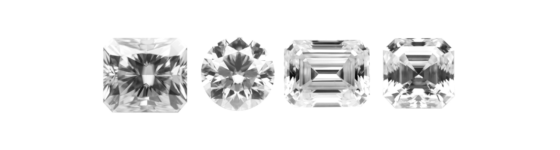

When we talk about investments that capture the imagination, pure diamonds are guaranteed to score very highly. Diamonds come in many sizes, weights, cut shapes and colours. They all have one thing in common: with 10 on the Mohs scale of mineral hardness, they are the hardest stones found in nature. In this article, we discuss the clarity of diamonds and explain how this affects their value.

How to tell the clarity of a diamond

How does the Brexit influence investing?

The foreign exchange market has had the most and quickest impact. The British pound suffered its biggest blow in thirty years after the referendum. The consequences for owners of British shares are correspondingly. But what else could be influenced by the Brexit? The long-term consequences are hard to predict because a lot will depend on the trade agreements the United Kingdom will have (re)negotiate now.

Which types of investment suit my investment profile?

A good investment portfolio is completely tailored to your investment profile. You would not buy a car that does not satisfy all your requirements, so why would an investment be any different? And these requirements will always differ from person to person. What are my ideal investments? How does my portfolio suit me?

Diamonds at the best price? Opt for our smart buy approach!

Interested in buying diamonds as an investment? Then you will obviously mainly want to pay the inventory value of the gemstones. You are therefore looking for the best diamond at the best possible price. This optimal price-quality ratio is something you’ll find at BNT Diamonds. Quite a strong statement, we are well aware of that. But please do read on and discover for yourself why we are right. The secret of our price tags? Our smart buy approach.

Which special diamonds should be in my investment portfolio?

Why should I add coloured diamonds to my investment portfolio? Which colours are the rarest? As an investor, you know that for a safe long-term investment you should be focused on a diversified investment portfolio. The alternative diamond value category is a perfect addition. All diamonds are precious and unique, but some are of course even rarer than others. We are happy to give you more information about these ‘special diamonds’ and their colours.

What does the De Beers name mean within today’s diamond market?

The diamond industry was almost entirely controlled by the diamond giant De Beers in the last century, with 80% of all rough diamonds in the world in their possession. They thereby attempted to monitor global demand and therefore also the prices. These days the De Beers share has been reduced to 20%. The current world leader Alrosa has taken over their leading position with 28% of the diamond market. How has the price of the diamond evolved? What role does De Beers still play today?